10 Best Operational Risk Management Software

There are numerous types of business risk that enterprises face, but some of the most common include operational risk.

Operational risk includes unexpected failures or disruptions in your company’s day-to-day operations, ranging from technical failures such as an outage, to employee errors, fraud or failed procedures and policies.

Top 10 Software

What is the Best Operational Risk Management Software ?

There are many tools that can help your company with operational risk management, including the ones listed in this article.

1. LogicGate

LlogicGate puts you at the center of all ERM processes so you can identify, assess, and mitigate risks across your business in one place with Risk Cloud. Uncover new opportunities to grow and make smarter decisions, faster. Get a deeper insight with enterprise risk management software that connects your risks, assets, and controls.

Don’t fear it, own it. Some call them risks, we call them opportunities. It can be overwhelming to spot, monitor, and prepare for potential risks across your whole organization. But it doesn’t have to be. Automate tasks, simplify processes, build a holistic risk management program, and generally make your life easier with Risk Cloud. With flexible solutions, you can start from anywhere and add more frameworks and processes as your GRC program matures. And because it’s all in Risk Cloud, you can easily link the components of your program so your team has all the related information they need on one screen to do their jobs more efficiently and make smarter decisions.

A ready-to-use ERM Applications built right into a Risk Cloud platform waiting for you. Choose the Applications that best meets your business’s needs, customize the workflows, then assess risk across your entire organization in one place. And yes, it’s really that easy.

Enterprise Risk Management (ERM) is the culture, capabilities, and practices that organizations integrate with their strategy. With the goal of managing risk and realizing value, ERM can identify, assess, and prepare you for any potential dangers, hazards, and physical or figurative disasters that may interfere with an organization’s operations and objectives.

Risk Cloud is a cloud-based platform with a suite of pre-built Applications that transforms the way you manage GRC processes by combining expert-level content and service with easy, no-code technology.

Risk Cloud’s Enterprise Risk Management Application makes it easy to build your holistic risk management process as it captures everything from vendor interactions and finance, to sales and marketing activities. This Application gives risk teams the tools to break down silos, automate tasks, and simplify processes for increased unity across the organization.

2. Hyperproof

Using HyperProof, break down risk silos and avoid redundant activities. Identify, assess, and manage your risks in the context of your company’s core mission and objectives. Maintain a central registry to track risks and document risk mitigation plans, map controls to risks and compliance requirements, and reduce time spent on monitoring risks.

With Hyperproof you can monitor your risk, security, and compliance posture in real-time via dashboards, showcase your team’s progress with custom reports, and effectively communicate to company executives why security and compliance work matter. You can even build ad-hoc, customizable reports to answer your own or your stakeholders questions quickly.

– Assess risks and maintain continuous compliance

Compliance, business, and security initiatives are often represented as unique streams of work even when they share certain activities and a common risk mitigation objective. For instance, risk management is a key domain within several compliance programs, such as ISO27001, NIST CSF and NIST SP 800-53. To comply with these frameworks, your organization needs to maintain an accurate risk register and understand how risk decisions and remediation efforts impact compliance program health.

– Identify, assess, and prioritize risks

With Hyperproof’s intuitive Risk Register, risk owners from all functions and business units can document their risks and risk treatment plans, and organizations’ leaders can better prioritize risk management activities. Risk scoring criteria can be customized.

– Integrate risk and compliance activities

With Hyperproof, you can tie a control to a risk and gauge how much of a specific risk has been mitigated by existing controls vs. the residual risk that remains. Provide your leadership team with insights into how risks are being managed and which risk mitigation activities to prioritize.

– Reduce time spent on monitoring risks

Hyperproof allows you to spend less time monitoring and determining the latest risk status as remediation activities are completed. As product and/or control owners complete mitigation procedures attached to a risk, the actual risk health is updated automatically in Hyperproof.

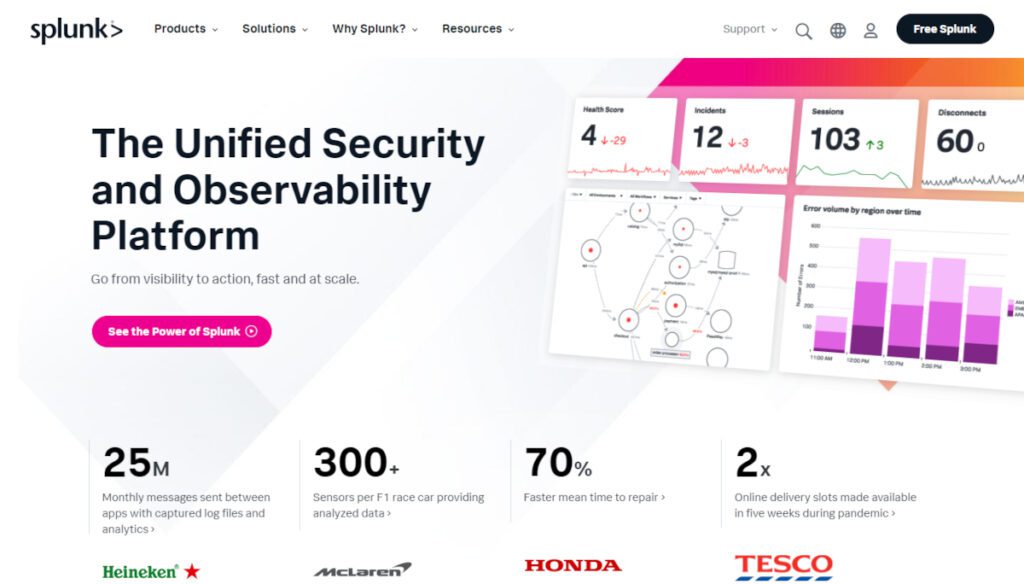

3. Splunk

The Splunk platform enables end-to-end visibility from edge to cloud, risk management is the practice of proactively evaluating where your organization is vulnerable to threats, then assessing and mitigating those threats.

The Splunk platform removes the barriers between data and action, empowering observability, IT and security teams to ensure their organizations are secure, resilient and innovative.

Founded in 2003, Splunk is a global company with over 7 500 employees, Splunkers have received over 1,020 patents to date and availability in 21 regions around the world and offers an open, extensible data platform that supports shared data across any environment so that all teams in an organization can get end-to-end visibility, with context, for every interaction and business process. Build a strong data foundation with Splunk.

Leverage the Splunk platform from anywhere, whether you’re on-premises, at home, in your data center or a combination of them all with a unified hybrid experience.

– Machine learning and AI

Predict and prevent, don’t just react. Improve security and business outcomes by bringing machine-level intelligence to your data.

– Data streaming

Collect, process and distribute data to Splunk and other destinations in milliseconds with real-time stream processing.

– Scalable index

Collect and ingest data from thousands of sources and counting, all at terabyte scale.

– Collaborative tools

Interact and collaborate from anywhere with mobile, TV and augmented reality capabilities.

– Analytics workspace

React instantly with visualization. Convert logs into metrics, boost search and monitoring performance, and streamline alerting functions.

– Powerful dashboards

Easily communicate even your most complex data stories using an intuitive dashboard-building experience.

Splunk is a cost effective, flexible and integrated solution that can help meet a variety of compliance requirements and beyond. Some of the ways Splunk helps meet mandates include:

- Continuous monitoring of security controls and their effectiveness

- Audit trail collection and reporting

- Determine acceptability of security controls in terms of risk levels

- Enable assessment of implementation and effectiveness of controls

- Collect, retain, search, alert and report on logs from all assets and activities

4. JCAD

JCAD is a leader in risk management and claims handling solutions, they have been providing software for more than 25 years. Streamline and enhance compliance and enterprise risk management with JCAD’s risk management solution, JCAD CORE. This fully customisable compliance and risk management software lets you manage risk to the level you want, with powerful monitoring and reporting functions to help you make informed decisions.

The new features in CORE are:

– API Integration

API Integrations allow you to connect to Power BI Solutions, SAP, Oracle and more.

– Fresh New Interface

Fresh new interface & improved navigation encourages user engagement

– Smartphone Compatibility

Smartphone Compatibility provides full functionality of the system from your phone

– Custom Fields

Using JCAD CORE will help you:

– Proactively identify, monitor and mitigate risk

Protect your business, your reputation, your employees and your customers, while tracking events and logging preventative measures.

– Ensure corporate compliance

JCAD CORE is currently helping businesses manage health and safety risk assessments, financial compliance and controls, information security according to ISO 27001 and CQC fundamental care standards.

– Capitalise on new opportunities

Risk management isn’t just about the negative consequences and JCAD CORE can help you exploit potentially positive outcomes.

– Drive effective business strategy

Real-time information, combined with customisable reporting, helps to ensure decisions are made with robust intelligence.

– Improve efficiency

Monitor records, store documents, view tasks, capture recommendations and demonstrate proof of compliance all from one central location.

5. DNV

DNV’s risk management software – Synergi Life is one of the world’s most recognized EH&S (environment, health and safety) software brands, according to Verdantix Global EH&S Survey 2016, 2017 and 2018.

With Synergi Life risk management software you have all the tools you need to manage QHSE (or HSE) non-conformances, incidents, risk, risk analyses, audits, assessments and improvement suggestions. Synergi Life’s QHSE software system for enterprise risk is used by over 350 companies worldwide, with more than 750,000 users globally, across a number of industries and businesses, such as energy, healthcare, transport, local government, construction and more.

This incident management software has a:

– Comprehensive QHSE software providing a management system and risk management solution

– Optional modules that fit your business needs

– Ability to streamline processes and report on-the-go with optional mobile app solution

– Software based on DNV’s extensive experience in QHSE and risk management

– DNV expertise within each business sector

– Industry-specific solutions that are up-to-date according to business standards and all new requirements for QHSE software

A risk and QHSE focus in your health and safety management system:

In a global business environment there is a great awareness of risk, yet most companies lack a complete picture of their enterprise risk portfolio. Companies need to address risk quickly and demonstrate risk performance in real-time, in an accountable and transparent way with risk management software. Synergi Life is a comprehensive business solution for QHSE (quality, health, safety and environment) and risk management – managing all non-conformances, incidents, risk, risk analyses, audits, assessments and improvement suggestions.

Processes in Synergi Life software for QHSE management:

– Incident management and reporting

– QHSE management

– Processing

– Analysing

– Corrective actions

– Communication

– Experience transfer

– Trending and KPI monitoring

6. AccountableHQ

AccountableHQ is the all-in-one compliance management software designed to guide you step-by-step to your goals. Accountable Compliance Success Managers are dedicated to making sure your company is fully compliant as it guides you step-by-step through the process of achieving compliance and setting up your risk management program.

With an All-in-One Risk Management Platform, keep your company safe and secure with one powerful platform. As your company scales, the risks you face scale along with it, Accountable helps you manage that risk by giving you the tools you need to protect your company.

It has features to power any privacy, security, and risk management program:

- Playbooks

- Security Risk Assessment

- Employee Portal & Training

- Data Breach Monitoring

- Vendor Management Software

- Policy Management

- $100k Compliance Protection

- Privacy Compliance Software

- Privacy Center

- Data Inventory Management

- Privacy Incident Response

ORM (operational risk management) is a recurrent process that comprises risk assessment, risk decision making, and risk control implementation, resulting in risk acceptance, mitigation, or avoidance.

Every business encounters conditions or fundamental changes in its status that might pose varying levels of risk, ranging from small inconveniences to a situation that could put the company’s whole operation in danger.

When dealing with operational risk, the company must take into account all of its goals. Due to the pervasiveness of operational risk, the objective is to minimize and control all risks to a tolerable level. Operational Risk Management aims to decrease risks by identifying them, assessing them, measuring and mitigating them, and monitoring and reporting them.

7. Riskonnect

Riskonnect is a platform everyone loves, every Riskonnect product is powerful on its own, but the real magic happens when you use them together. Users love its familiar interface, procurement loves its scalability, and IT loves its built-in security. And that translates into faster time to value for everyone. Get the data, analytics, and insights to turn risk in to strategic advantage with Riskonnect’s Risk Management Information System.

The pressure is on to manage evolving risk, anticipate what’s around the corner, and analyze the big-picture impact all in less time with fewer resources. Riskonnect’s risk management information system gives you unprecedented insight into your risks, their relationships, and the cumulative impact on the organization so you can make smarter decisions faster.

The risk management information system is built on a secure, simple-to-use platform that tackles your daily risk management challenges with better data, faster analytics, and smarter insights.

Riskonnect puts everything you need to manage risk right at your fingertips by seamlessly integrating people, systems, and data from multiple internal and external sources. The platform opens lines of communication and promotes collaboration throughout your entire enterprise. And when you make more informed decisions about risk, costs go down and profitability goes up.

- Riskonnect Integrates

- Integrates: Seamlessly consolidates data from multiple internal and external data sources for a holistic view of your risks.

- Automates: Streamlines and automates routine processes so you can spend less time consolidating and more time analysing.

- Analyses: Uses sophisticated analytics to turn complicated data into easily actionable information.

The Riskonnect Risk Management Information System has everything you need to manage risk:

- Certificate Management

- Claims Administration

- Claims Regulatory Compliance

- Cost Allocations

- Exposure Management

- Incident Management

- Insurance Management

- Root Cause Analysis

- Reporting & Analytics

8. Resolver

Resolver gathers all risk data and analyzes it in context revealing the true business impact within every risk.

With risk intelligence, go from risk data to Business Value:

– Get your risk together

Collect and connect all types of risk data across every corner of the business.

– Rank risks by impact

Understand risks in context and quantify the business value of each.

Using the power of the platform:

– PRIORITIZE

Plan intelligently by framing every risk in terms of business impact. So you know which risks to tackle when and bring value to the boardroom.

– ANALYZE

Blend risk data to uncover intelligence hidden within. Prepare for future risks and always stay one step ahead.

– ADDRESS

Coordinate the right teams, at the right times so you respond with precision. Not just the bearer of bad news, risk becomes a proactive driver of value.

Risk Intelligence covers it all:

– Risk & Audit

Build a mature risk culture by connecting risks to reality. Understand the multiple layers of risk and the effectiveness of your controls with solutions covering:

-Enterprise risk management

-Operational risk management

-Security risk & site audits

-Internal audits

-Vendor risk

– Compliance

Simplify multi-jurisdictional obligations into clear, practical requirements so you track issues, drive accountability, and ensure compliance with tools such as:

– Regulatory compliance management

– Internal controls

– IT risk & compliance

– Regulatory change tracking

9. Cority

Cority’s CorityOne helps you streamline and simplify the identification, evaluation and control of operational risk, providing leaders at all levels with enhanced real-time visibility of where risk exists in the business, enabling faster, more intelligent decisions to protect your workforce and keep the organization on a path toward better performance. Shift your corporate risk management philosophy from reactive to proactive with powerful risk management solutions built on a holistic approach to risk-based thinking.

– Enhance your view of operational risk

Enhance the visibility and awareness of operational risk across the business to drive better decisions that help mitigate losses and support better operational performance with flexible, real-time access to risk data across the entire Cority risk management software platform.

– Strengthen compliance

Improve organizational compliance to applicable risk management regulations, standards, and corporate policies. Mitigate the risk of loss, reduce exposure to regulatory citations and penalties, and protect your brand.

– Drive engagement

Leverage purpose-built tools to help share risk information broadly across the workforce to support better risk control and drive greater employee participation in risk management actions and decisions.

Have better results through better risk management solution:

– Standardized processes

Simplify, standardize, and streamline risk management practices, reducing associated time and effort while ensuring process consistency and reliability that lead to better results.

– Better efficiency

Reduce time-consuming manual data entry tasks, limit risk of data loss or corruption, and free up staff to spend their time on more critical tasks and functions.

– Insights that drive results

Track, trend and analyze results over time with Cority’s robust risk management software to uncover insights that help you assess mitigation efforts, identify residual risk and opportunities, and calculate the ROI of your risk prevention strategy.

10. Wolters Kluwer

Wolters Kluwer is a global provider of professional information, software solutions, and services for clinicians, accountants, lawyers, and tax, finance, audit, risk, compliance, and regulatory sectors.

A risk management software that manages the effects of uncertainty on your organization’s objectives. Go beyond compliance and gain a competitive edge by improving operational and business performance through effective risk assessments.

Risk management is key to manage uncertainty that may impact objectives. When done effectively, it gives a competitive advantage. With increasing uncertainty both at the enterprise and operational level, risk management is critical. Organizations must proactively manage risk rather than reactively manage incidents. The Enablon Risk Management software application is an integrated solution to identify, assess, and mitigate risks across the enterprise.

– Ensure consistency

Standardize risk management processes with consistent risk assessment and evaluation methodologies, while supporting contextual risk consequence thresholds for different departments or business areas. Establish common risk form templates for risk registers.

– Improve risk assessments

Facilitate top-down and bottom-up approaches for risk identification. Analyze risks by usingbow-tie functionality to determine causes and consequences, and define and evaluatepreventive and mitigating controls.

– Better manage KRIs

Establish measurable Key Risk Indicators (KRIs) and tie them to risk appetite statements. These can then be associated to specific risks in the risk register to track periodic performance against these indicators.

– Comply with ISO 31000 and COSO

Meet corporate objectives by enabling a systemic approach to risk management through compliance with the ISO 31000 Risk Management guidelines or the COSO Enterprise Risk Management integrated framework.

– Configurable campaigns and workflows

Support bottom-up risk management processes through risk assessment campaigns and owner-validated risk flows. With flexible workflow configuration, organizations can define even the most complex of role-based validation requirements.

– Track the evolution of risks

Monitor risks with risk indicators and automated reporting. Also, risk versioning allows organizations to take automated, periodic snapshots of active risks to track the evolution of risks.

Conclusion

With everything from increasingly stringent compliance regulations to prolific and destructive cybersecurity threats, it’s well-established that enterprises continue to face mounting risk to their data, their assets and their reputation. Consequently, effective risk management is now an essential component of enterprise operations.