10 Best Accounting Practice Management Software

Accounting practice management software manages the front- and back-office operations for companies providing accounting services. This type of software is used to organize the services offering of a company, as well as to track delivery using workflows and task management. Accounting practice management solutions help accounting professionals increase productivity and improve the relationships with their customers. These software products can be implemented and used across the entire company but are most beneficial for independent accountants.

Top 10 Software

What is the Best Accounting Practice Management Software ?

Accounting practice management software needs to integrate with accounting software and small-business accounting software. When not included in the product, integration with project management software is also essential. So below our selection of the Top Accounting Practice Management Software.

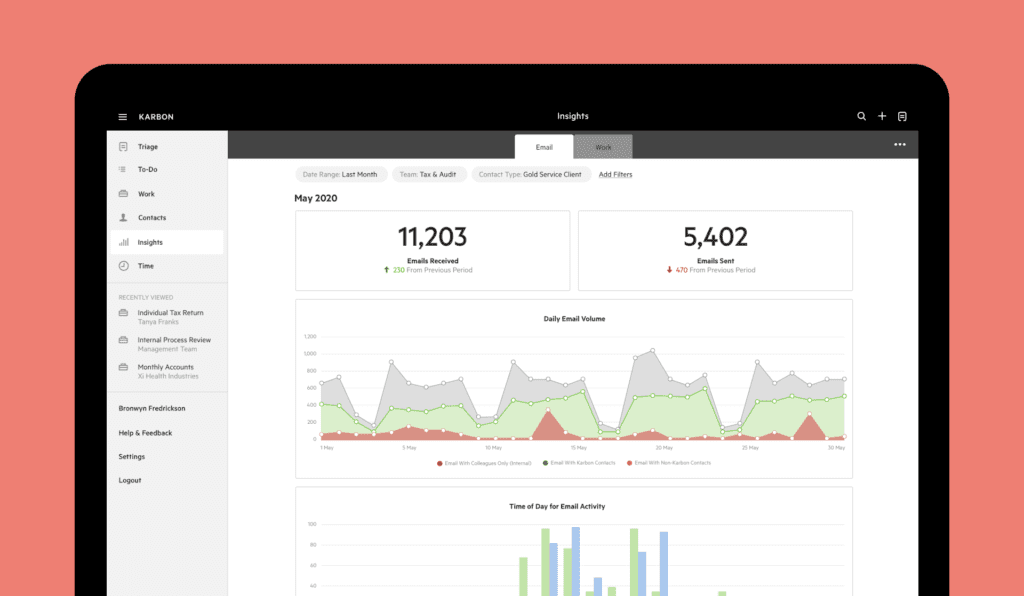

1.Karbon

Karbon Number 01 in our list of the Best Accounting Practice Management Software, it is a collaborative practice management platform for accounting firms. It brings your team, clients, systems, and data together in one place, significantly improving visibility, efficiency, and connectivity no matter where your people are located. Visibility & Control. Enjoy peace of mind knowing where every job stands, who’s working on what, and what’s being said to clients. Automation & Efficiency.

Get more out of every team member by automating tasks, standardizing common processes, scheduling data collection and scaling onboarding. Collaboration & Connectivity. Unite the firm with one place to collaborate on email, clients, jobs and tasks. Get more work done together, whether people are remote or in the office.

Let Karbon do all of the chasing for you by automating client requests and reminders. Clients become part of your workflow, so they know exactly what they need to action, and you know what you are still waiting on. Standardize your work with Karbon templates, ensuring processes don’t break and quality is maintained as your team evolves and grows. Don’t waste any more time on low-value admin. Set recurring work to repeat on automatic schedules so that no future client job will be missed, no matter how far ahead it is planned.

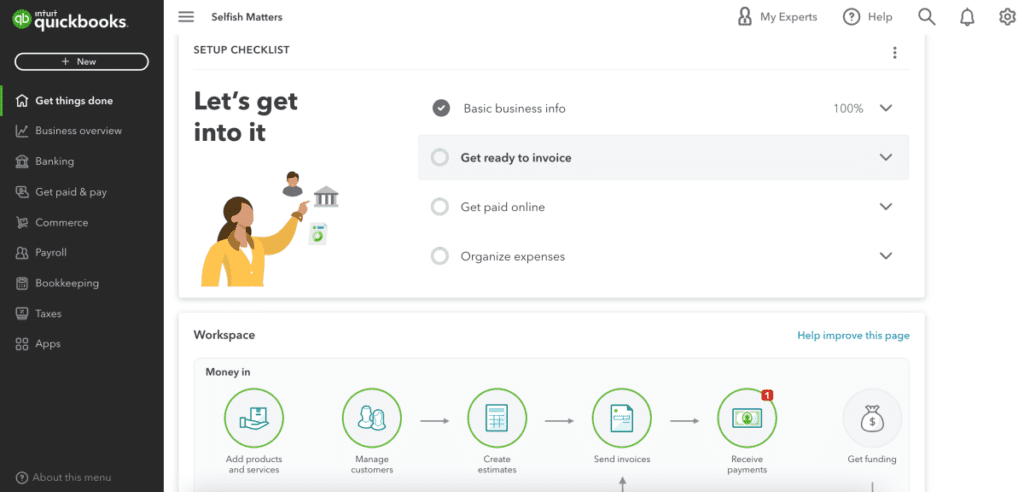

2. Quick books intuit

Intuit’s QuickBooks family of accounting websites and software remains our first choice for businesses trying to find the best way to automate their accounting. Since our last review of QuickBooks Online Plus, the version we recommend highly for most small businesses, the company has made improvements in multiple areas, including search, transaction categorization, mobile access, and onboarding. It’s also made a few cosmetic changes. Intuit rolls out its enhancements slowly, so you may or may not see all these changes yet. Also, like competing products, QuickBooks has developers who are always working behind the scenes, tweaking elements like performance and usability, and expanding the use of artificial intelligence in many areas.

QuickBooks Online offers the most effective blend of flexibility, usability, financial features, and extensibility. As such, it’s our Editors’ Choice winner for most small businesses and their accounting needs. For the very smallest businesses that might not need everything QuickBooks offers, FreshBooks is our other Editors’ Choice pick.

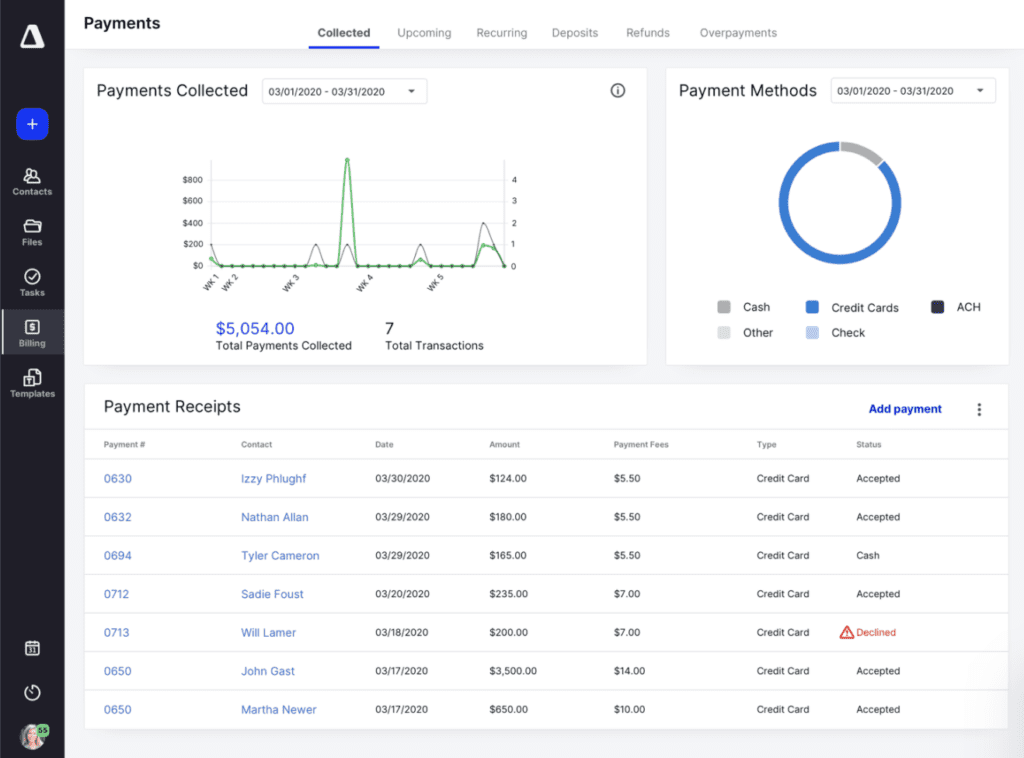

3. Canopy

Canopy is a cloud-based practice management and tax resolution platform for accounting firms, tax professionals, tax attorneys, and enrolled agents. It provides an integrated suite with various tools to help enhance efficiency while creating a connected client experience.

Canopy offers a mobile app where clients can securely share files, complete case to-do lists, e-sign documents, view invoices, and make payments. The app is compatible with iOS and Android devices. Canopy includes features such as birds-eye view, client requests, communications, automated workflows, custom templates, document review, payments, transcripts retrieval, tax resolution, notices, and more.

It comes with a practice management module, which allows users to automate client onboarding, manage secure file exchange, and track client communications. Pricing is on an annual subscription basis. Support is available via phone, online knowledge base, and video tutorials.

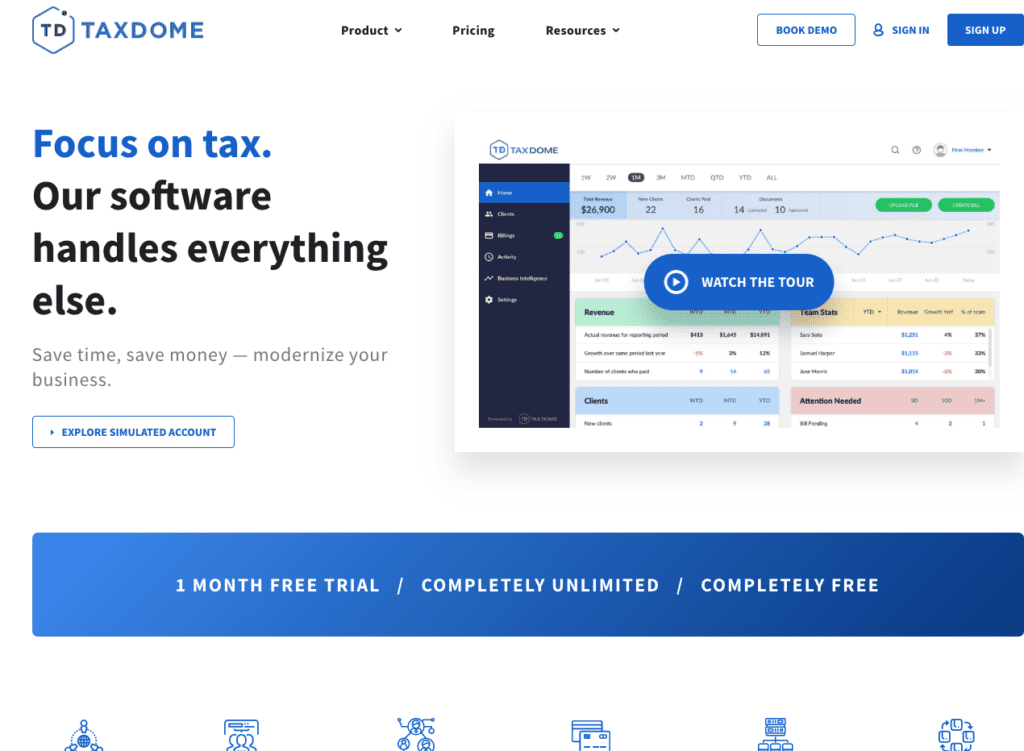

4. Taxdome

TaxDome is an all-in-one practice management platform for accountants, chartered accountants, bookkeepers, and accounting firms. TaxDome enables firms of all sizes to streamline their business by using a single platform for internal firm management (workflow, CRM [Customer Relationship Management], reporting) and client tools (documents, signatures, invoicing, messages ). All customers, all emails, all tasks, all invoices: all in one shared space for your team.

Improve the customer experience. As people get used to using online tools in e-commerce, banking and social media, they have come to expect the same ease of use from all businesses. with which they interact. The majority of tax and accounting firms are SMEs and do not have the same IT resources as large technology companies. TaxDome helps you avoid losing clients by providing them with a user-friendly client portal.

Automate customer communication and avoid customer churn. One of the main reasons for customer loss is a lack of communication from the company. You strive to meet deadlines, but without good communication, your customers don’t know what’s going on internally. TaxDome helps you automate this task with Workflow Automation. At each step, your customers are informed of your actions without you having to intervene.

Reduce administrative tasks. All the work done by tax, accounting and bookkeeping professionals is repeated on a regular basis. With TaxDome, you have an overview of the progress of your team and your projects, you can delegate tasks more easily and automatically perform a large number of repetitive tasks. Reduce time spent on administrative tasks and focus on the billable work you do for your clients.

5. Financial Cents

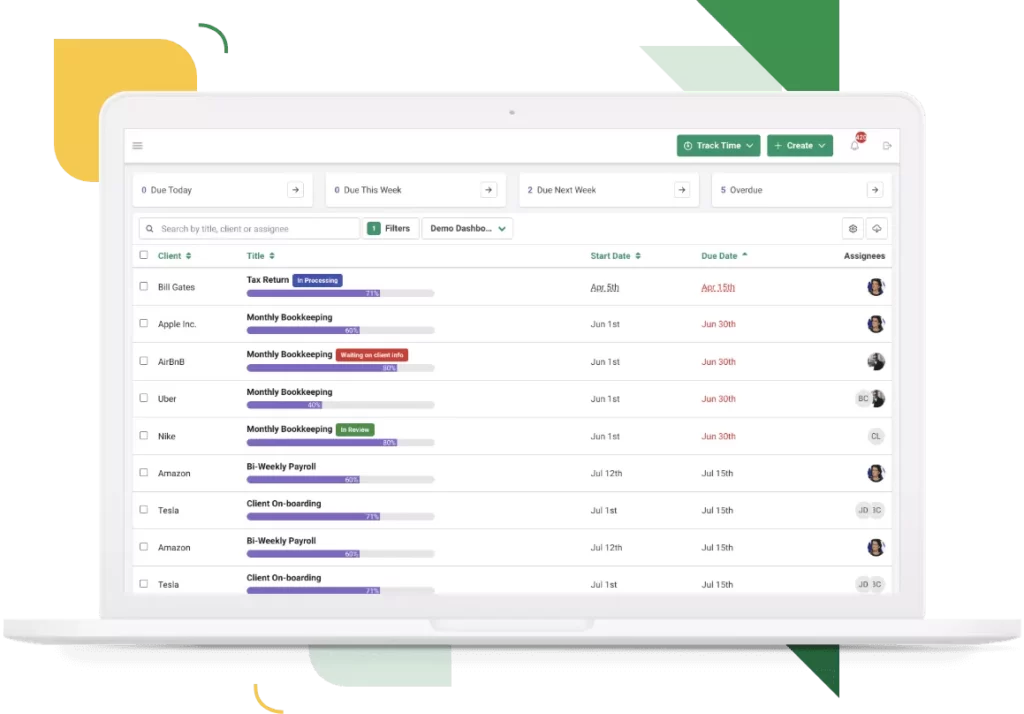

Financial Cents is accounting firm management software designed to help accounting firms automate data collection processes, manage projects, collaborate with staff members, and manage tasks in a centralized platform. Administrators can automate recurring projects, such as bi-weekly payroll or monthly bookkeeping, and use practice templates to streamline workflows across the organization.

Financial Cents allows team members to access customer interaction details and use the web portal to communicate and request required documents from customers. Supervisors can set milestones for tasks or subtasks, track billing processes, and configure access permissions for staff members. It also allows accounting firms to store client information such as contact details, documents, passwords and notes in a centralized repository.

With Financial Cents, accountants can track time spent on projects, export data to process invoices, and monitor client financial performance with custom reports. Accounting firms can also schedule automated reminders to follow up with clients and secure confidential information using Transport Layer Security (TLS) encryption.

6. Jetpack worlkflow

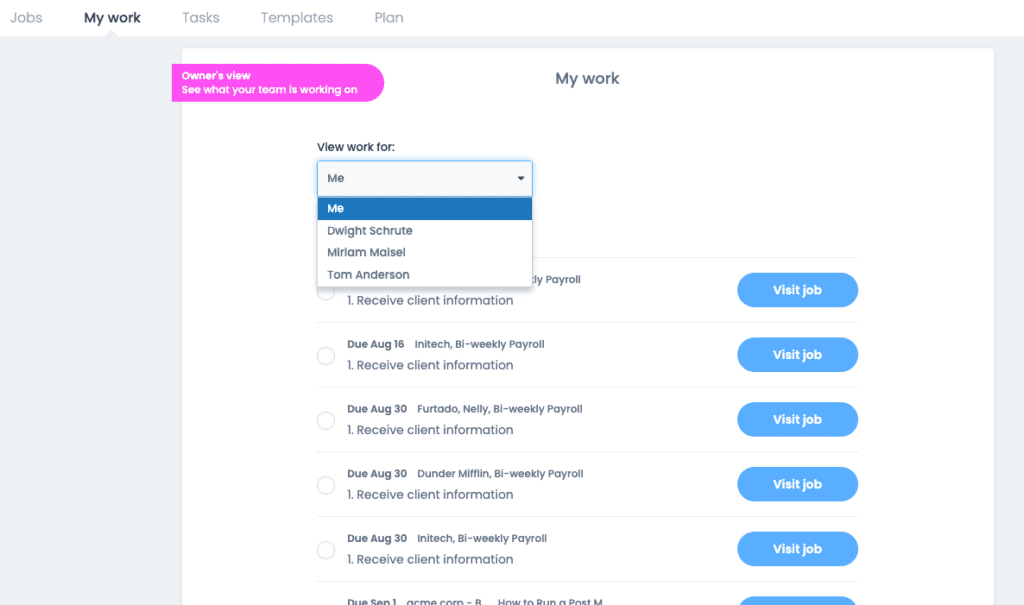

Jetpack Workflow is a workflow management tool that helps firms standardize, track and automate their processes allowing them to complete more work and prevent tasks from falling through the cracks. Serving over 16K customers globally, we help firm owners meet deadlines, track team progress, and grow their practice without worry.

Jetpack Workflow also offers native integration with QBO and the G-Suite, as well as our integration with Zapier, we keep you connected to all the important areas of your business and clients.

Our template library has over 70 ready-to-use templates that will get you organized, fast. With world-class support available via chat, phone, or email, our workflow specialists ensure you get the most out of our software so you can focus on growing your business.

7. Uku

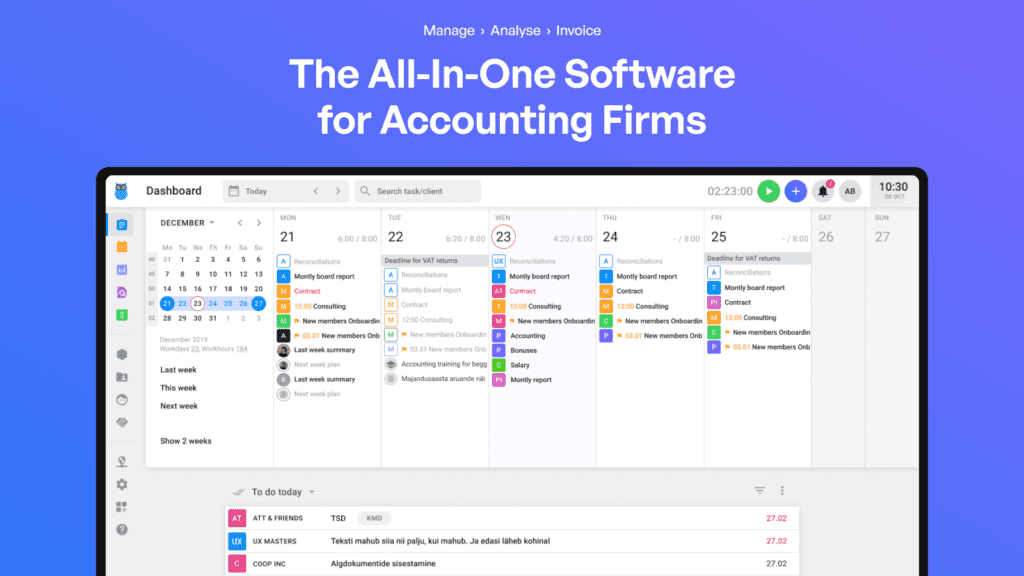

Uku is a powerful and elegant software for your accounting firm. It helps you plan work, manage a team, and keep track of workflow.

8.OfficeTools

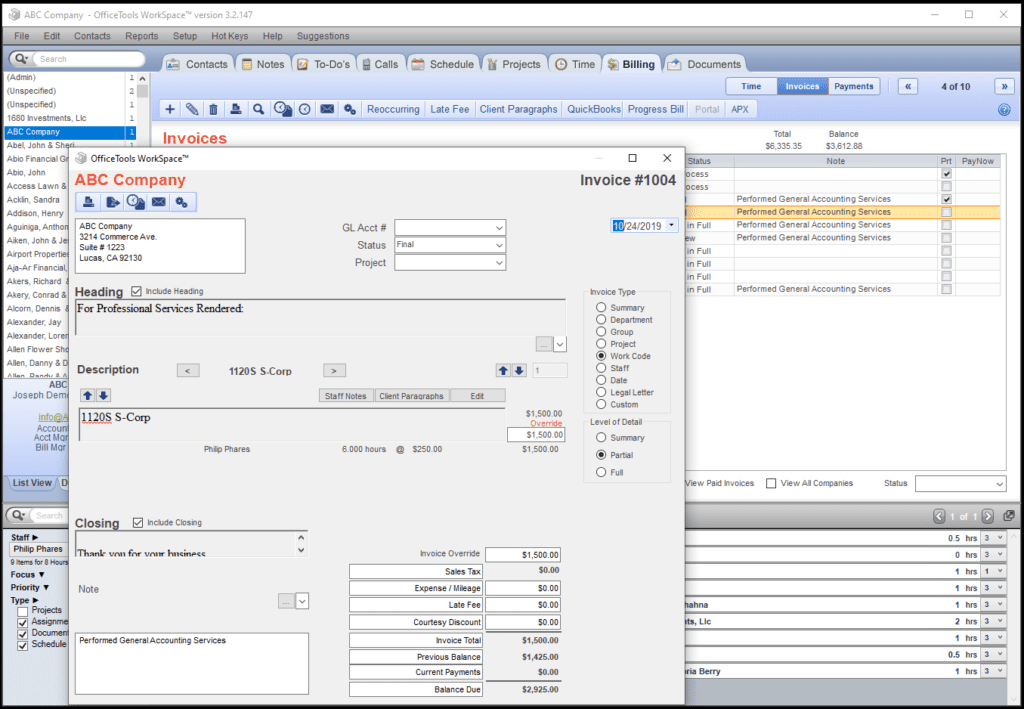

OfficeTools is an accounting and tax firm management solution that provides users with tools for managing clients, projects, tasks, documents, time, billing, and more.

OfficeTools WorkSpace acts as a centralized repository of all client information and syncs bi-directionally with tax and accounting software to ensure data changes are updated across all systems. Projects, appointments, and assignments can be tracked in personal and group calendars, while tasks can be delegated to team members who have a lower workload. The activity list provides users with a view of all open items pending completion and allows users to view the relevant contact and section for each task. Users can record the time spent working with each project or client using built-in timers and synchronize this data with the invoicing and payroll system.

OfficeTools WorkSpace Portal allows customers to request appointments, sign documents and make payments online. Email and SMS confirmations and reminders let customers know the time and date of upcoming appointments. On the day of the interview, the client onboarding/registration system can be used to collect updates to clients’ personal information and contact details. Built-in electronic signature functionality allows customers to electronically sign documents while supporting multi-party and sequential signatures. All signed documents are stored automatically and users can communicate directly with customers through the portal to address their concerns, queries or requests for documents and information.

9. Safe send

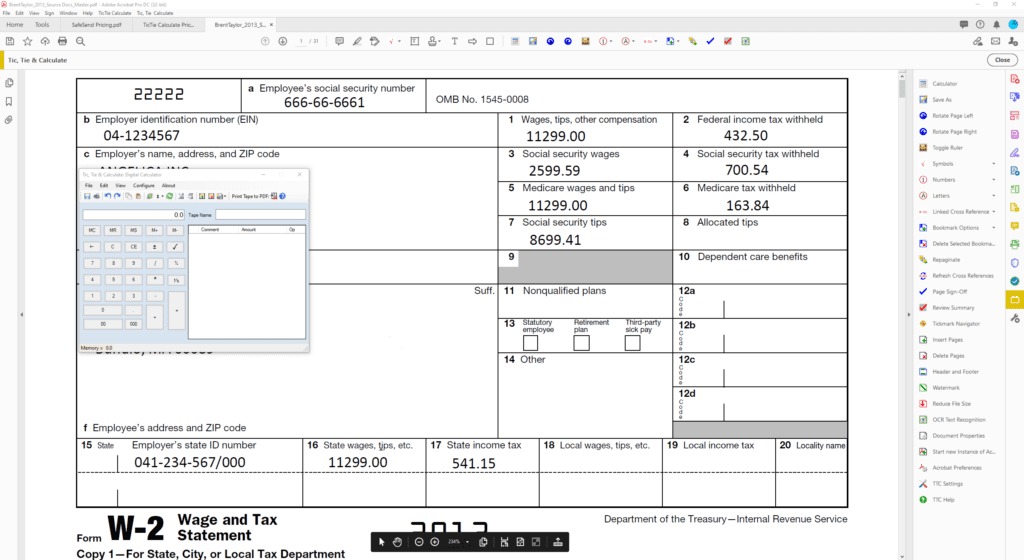

SafeSend is an accounting practice management software that helps practitioners automate tax and accounting operations. The platform enables administrators to share electronically fillable organizers with clients and capture digital signatures.

Managers can send vouchers and estimated payment reminders to customers, collect tax preparation fees, and generate invoices. SafeSend allows teams to email encrypted tax documents to bank authorities. Supervisors can also prepare and review electronic PDF workpapers on a unified interface.

SafeSend lets businesses automatically assemble and group transmittals as well as payment vouchers. Operators can also capture client details and track various steps of tax returns on a centralized dashboard.

10. Accountancy Manager

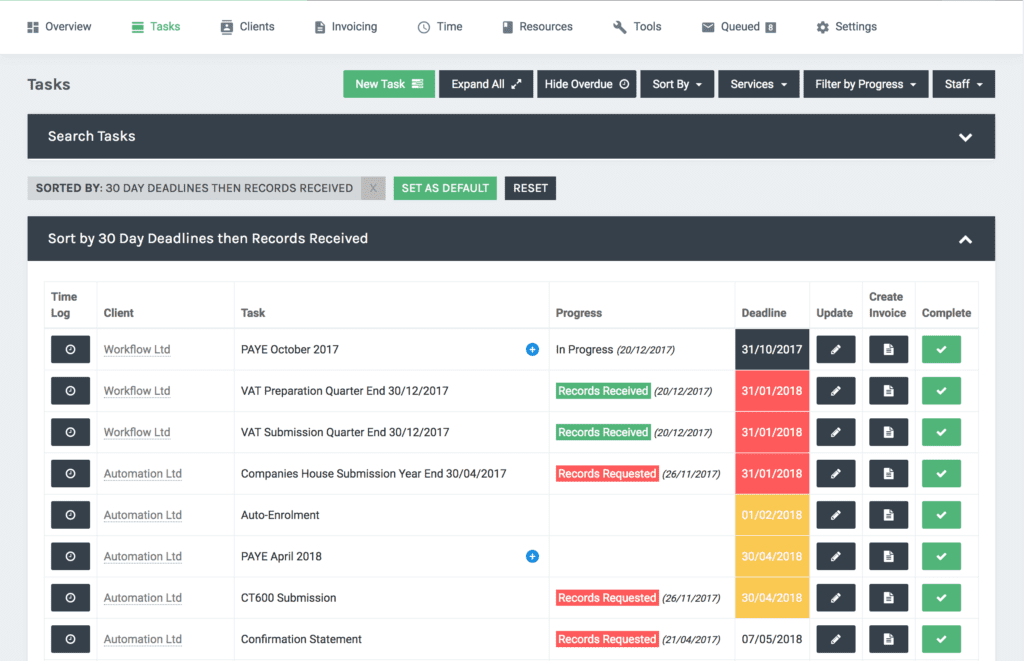

AccountancyManager is a multi-award-winning, cloud-based practice management software – designed by accountants and used by thousands of accountants and bookkeepers across the UK and Ireland. Our fully customisable practice management solution enables you to automate your admin, onboard clients with ease and is ready to go straight-out-of-the-box with a quick client import.

Finally to qualify for inclusion in the Accounting Practice Management category, a product must:

Maintain the portfolio of services offered by professional accountants

Manage relationships with customers and prospects

Monitor tasks and activities related to the accounting practice

Provide portals for customers to communicate with accountants

Track the status of each project and calculate the billable time

Create invoices for the services provided and track payments.